Oliver’s Dream

Living with Hypertrophic Cardiomyopathy, keeps Ollie and his family on constant alert. But this happy and easy going 10 year old has a good heart;

Giving the gift of hope by fulfilling dreams for children in Alberta diagnosed with severe chronic or life-threatening medical illness.

All funds raised are used to fulfill dreams for children right here in Alberta. Along with children who have life-threatening conditions, we also fulfill dreams for children who have severe chronic medical illnesses. Children referred for a dream often must cope with illnesses that require multiple hospital stays, complex treatments in addition to the stress and fears that come with their reality. They have undergone medical procedures that would make most adults weary.

Realizing a dream can provide a much-needed break from the daily struggles of illness, medications, and treatments. It can offer moments of joy and hope. A break from the physical and emotional toll of being ill or missing out on their childhood. Fulfillment of a dream can also provide an opportunity for the entire family a chance to come together to celebrate the child. It can be a powerful catalyst, boosting the emotional and physical well-being of the child, giving them the strength and courage they need to keep fighting their illness. The fulfillment of a dream creates an opportunity to create precious memories that will last a lifetime, and can be a source of inspiration knowing that their community is behind them supporting them as they navigate the challenges of their illness.

Alberta Dreams believes every child facing severe chronic or life-threatening illness in Alberta deserves a chance to dream and experience the joy of seeing their dreams come true. We work tirelessly to make that reality for as many children in Alberta as possible, bringing hope and happiness into the lives of those who need it most. A Dream gives hope, it gives strength, it provides inspiration that each child is more than their diagnosis.

In 2021, our administrative costs accounted for only 7% of our total expenses for the year.

Living with Hypertrophic Cardiomyopathy, keeps Ollie and his family on constant alert. But this happy and easy going 10 year old has a good heart;

Being non-verbal has many of its own challenges but Claire’s love of music, especially the piano, is apparent for all who see her with her

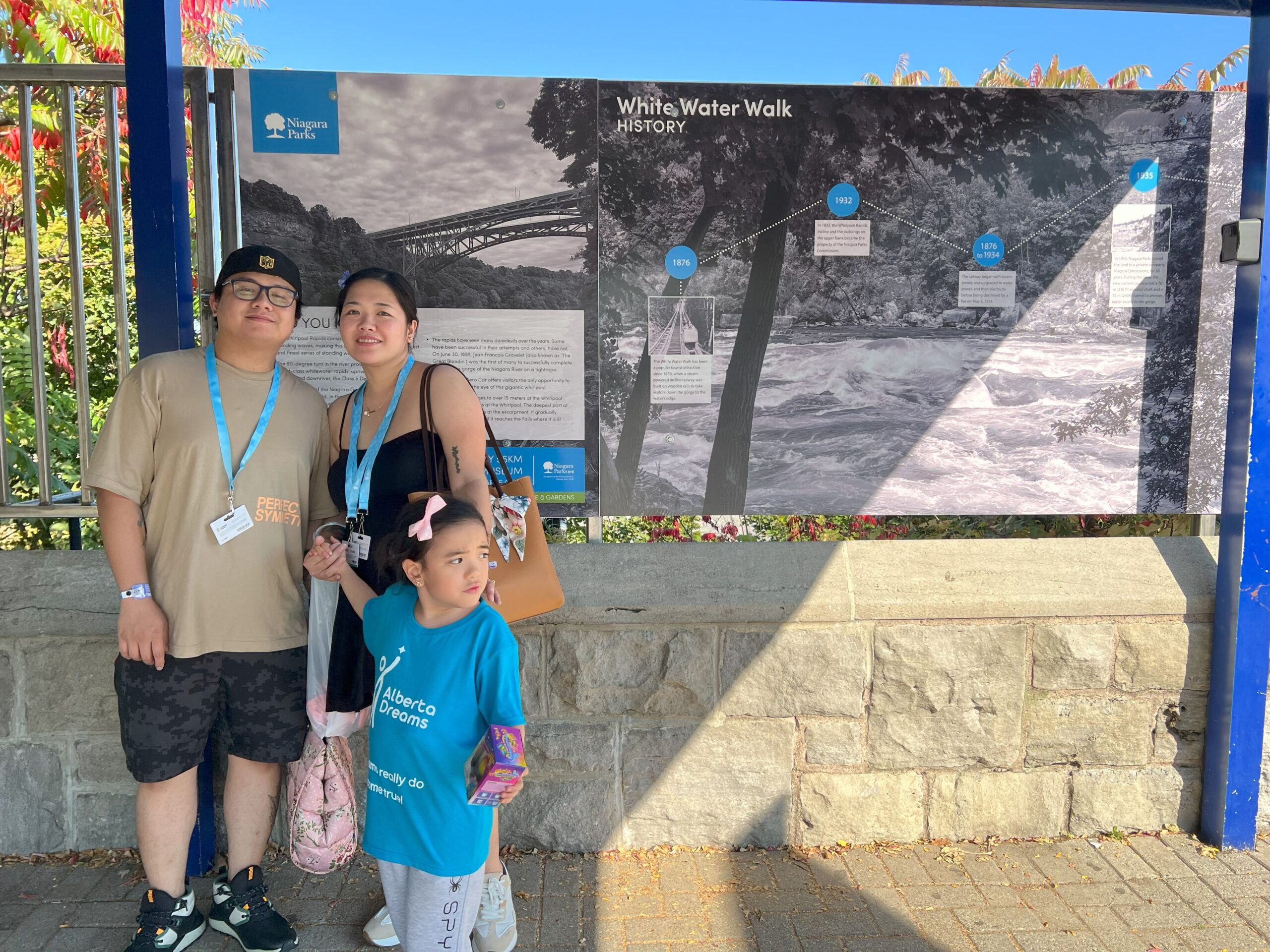

Kennice’s dream for quality time with her family came true with an amazing visit to Niagara Falls and Toronto. She and her family relaxed and

This outgoing and social 4 year old lights up the room everywhere she goes. She is confident, loves people, being the center of attention and

In a small northern Alberta community, this teen is finally thriving with life on the farm. Diagnosed with Clathrin Light Factor Disorder I, gross motor,

This passionate soccer player’s journey began as what they thought was a sports injury that just wouldn’t heal. After a lifelong passion for the sport

Event Date: 2024/05/25 Location: Jerry Forbes Centre #7, 12122 68st NW, Edmonton. Contact: 780-469-3306 [email protected] For more information on the AGM, please click below. Click

Mega Bounce Run YYC Are you ready? Mega fun is back as our team brings the craziest inflatables to locations across Canada. This is a

Event Date: 2024/06/06 Location: The Winston Golf Club. Contact: Amy Smart 780-717-5503 or email [email protected] 18 Hole – Shotgun start at 1:30pm Join us on